Compound interest calculator sp500

Depreciation plus mortgage interest expense leads you to for tax purposes more or less break even on this investment after 10 years and so you pay no tax. Additionally this decade I am behind the sp500 total return by 6 percent as of aug.

Courage We Have Been Here Before Capital Group S P 500 Index Dow Jones Index Planning Essentials

Best Buy pays a healthy forward dividend yield of 495 and has grown its dividends at a massive 20 compound annual growth rate over the past five years.

. Your 100 contribution is now worth 210. The price-earnings ratio is very low at around 5. Bruush Oral Cares primary product offering is an.

It is a worldwide strategy and your investment should be guided by a senior professionalist. To the Shareholders of Pershing Square Holdings Ltd. In terms of valuation Alphabet Inc has a price-earnings ratio of 2272 a price-book ratio of 625 a price-earnings-to-growth PEG ratio of 085 a EV-to-Ebitda ratio of 1500 and a price-sales ratio of 598.

Try as you might bonds always end up in the results at either 20 or 40 of the portfolio. Use a compound interest calculator use a conservative annual interest rate then keep upping your contributions until you get to the number that will support your desired annual spend in retirement at 65 with the 4 rule. Julian Robertson Trades Portfolio.

Air Products Chemicals earnings per share have a compound annual growth rate of 6 over the last decade. You should start from small amounts and later can invest a greater amount of assets. Thats how you answer this question.

Total debt stood at 11644 billion as of the most recent quarter giving the company a weighted average interest rate of 48. FOX FILES combines in-depth news reporting from a variety of Fox News on-air talent. And head to the portfolio finder calculator.

Low interest rates and booming stock markets have caused many to think that bonds have no place in a portfolio. Since its inception the hedge fund has generated around 37 billion in profits for its investors of which around 10 billion was produced in 2021 profits have accelerated in recent years thanks to the benefits of compound interest as well as buoyant equity markets. Your effective interest rate becomes 100 PLUS 2x whatever the actual growth is.

Even assuming an 8 return nets 10mm and the historical average SP500 return is 105. Thanks to its top billing in its industry and investment in future projects the companys earnings per share without non-recurring items NRI growth rate is expected to accelerate to 166 over the next three to five years according. SP 500 index funds have become incredibly popular with investors and the reasons are simple.

The program will feature the breadth power and journalism of rotating Fox News anchors reporters and producers. Book value growth is steady at about 7 compound annual growth rate over the last decade. Contribute to the maximum your company will match.

BRSH Financial a newly listed company within the electric toothbrush space that is adopting this direct-to-consumer strategy and adding a subscription model in order to build a sense of consumer loyalty. The company is debt free with a pristine balance sheet. TCIs approach to investing is relatively simple.

Ignoring increasing property value compound interest opportunity cost that plenty of places put this between 1 and 4 and that pretty much all places indicate the rate increases. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. Let us take a closer look at its business and evaluate its stock as an investment prospect.

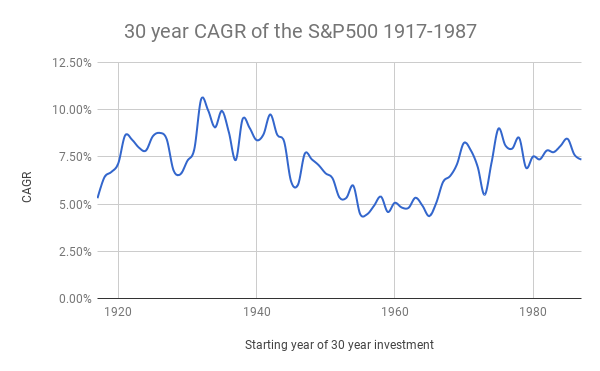

You put in 100 they put in 100 you earn interestgrowth on the combined total 200. Dollar cost calculator sp500 is quite easy to handle. Rolling Returns Provide A Great Way To View Market Performance This bar chart shows the rolling returns from 1973 - mid 2009 for the SP 500 Index over 1 3 5 10 15 and 20 years.

Learn more about investing in index funds with tips from Bankrate. As it keeps you safe from risks and major investments. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs.

Return on equity is about 55 but given such a low book value the book value adjusted ROE is over 16 which is quite good. The table included below illustrates where Lockheed Martins weighted average interest rate would need to reach before free cash flow no longer sufficiently covered dividend payments. GuruFocus gives the company a financial strength rating of 9 out of 10 and a profitability rating of 9 out of 10.

Their portfolio grows by 5 that year. In the first half of 2022 Pershing Square Holdings generated NAV performance of negative 260 and a slightly lower total shareholder return of negative 273 due to the widening of the discount to NAV at which PSHs shares traded5 PSHs year-to-date NAV return through August 16 2022 was negative. Valuation Best Buy trades at a forward price-earnings ratio of 115.

Fidelity Compound Interest

S P 500 How To Buy It And Turn 10 000 Into 420 000 Reverse The Crush

If The S P 500 Is Said To Grow By Around 7 Each Year Then Why Does Its Price Grow Linearly Instead Of Exponentionally Quora

S P 500 Top 4 Sectors To Invest In 2022 Investor Times

The Average Return Of The S P500

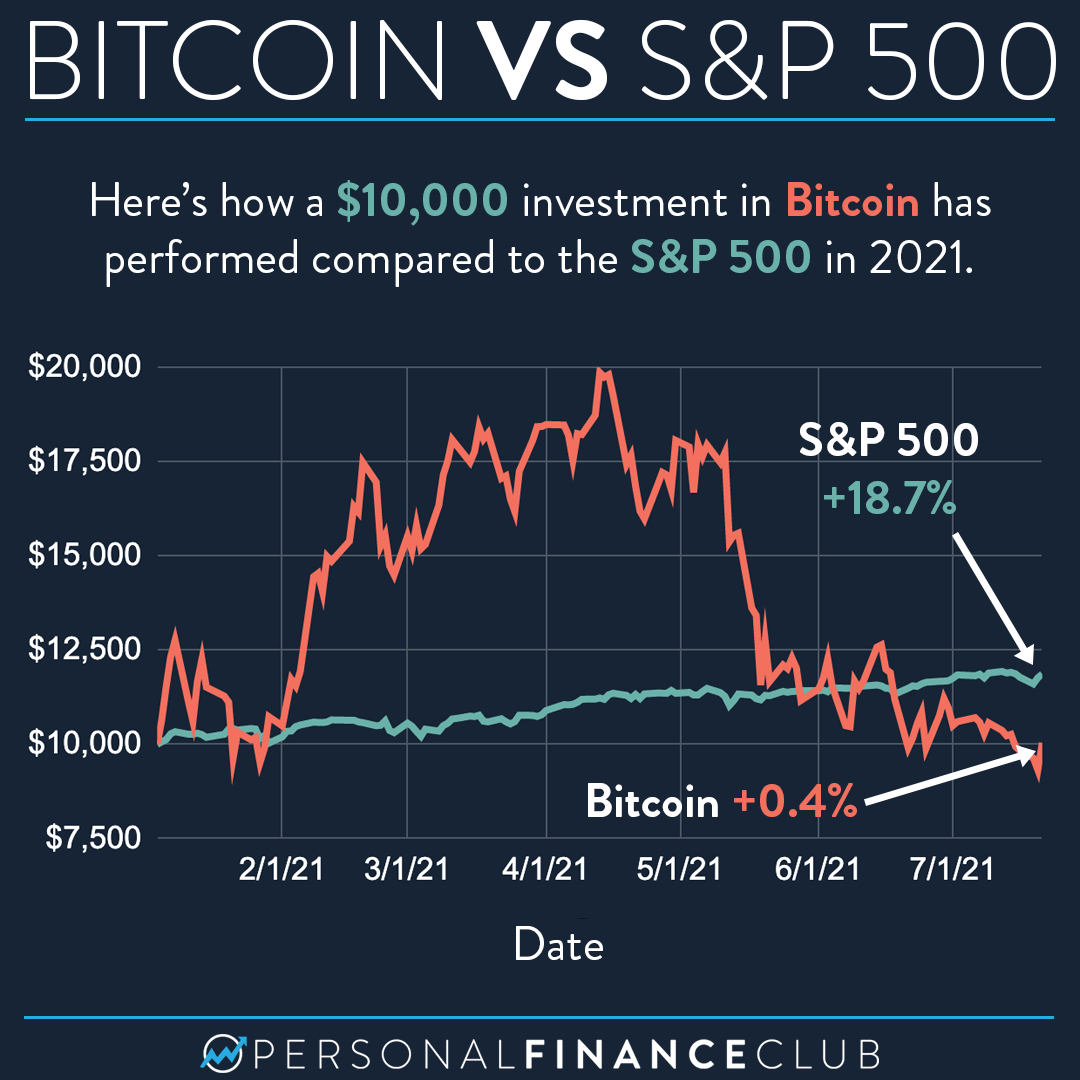

Here S How Bitcoin Performed Compared To The S P 500 In 2021 Personal Finance Club

The Power Of Reinvested S P500 Dividends Wealthy Corner

The Best S P 500 Index Funds For 2022 Benzinga

How The Options Market Ends Up Controlling The S P 500 In 2021 Investment Moats

D8mr8p8vphaecm

S P 500 What Are Current Valuations Telling Us Investing Com

How To Invest 100 000 To Make 1 Million Investment Calculator

The Average Return Of The S P500

The Power Of Reinvested S P500 Dividends Wealthy Corner

The Power Of Reinvested S P500 Dividends Wealthy Corner

S P 500 What Are Current Valuations Telling Us Investing Com

The S P 500 Index Historical Returns